It seems hardly a day goes by without a new report of a cyberattack. The average ransom payment shot up 82 percent from 2020 to 2021. By the middle of 2021, the number of ransomware attacks was up more than 150 percent over the entirety of 2020. These numbers are expected to grow significantly as attacks continue to rise in numbers and sophistication.

It seems hardly a day goes by without a new report of a cyberattack. The average ransom payment shot up 82 percent from 2020 to 2021. By the middle of 2021, the number of ransomware attacks was up more than 150 percent over the entirety of 2020. These numbers are expected to grow significantly as attacks continue to rise in numbers and sophistication.

As a result of this surge, cyber insurance has seen an uptick in demand. Seen as a powerful tool in protecting organizations from attacks, many are aware of the coverage, but don’t understand what a cyber insurance policy actually covers.

The Basics of Cyber Insurance – Know the 411

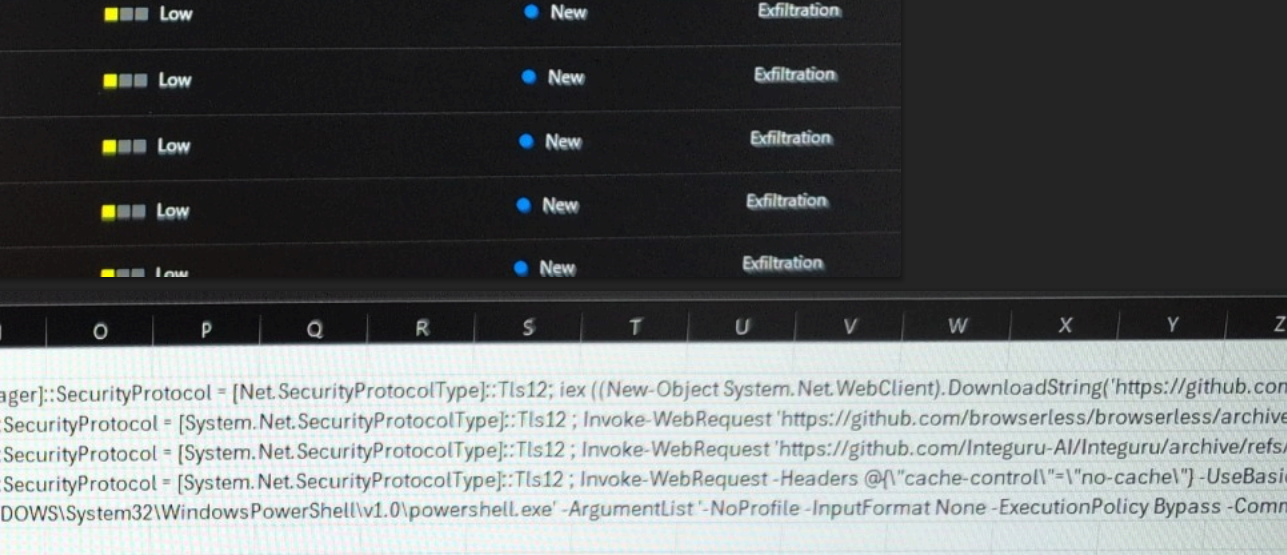

Cyber insurance covers the liability, costs, and risk of disruption that occur from a cyber attack, as well as non-malicious mistakes made by a user that lead to a cyber incident (accidentally making a database public, losing a laptop, etc.). In most cases, cyber insurance covers any expenses that result from a data breach or ransomware attack including regulatory fines, investigation processes, or customer notification.

We are often asked questions regarding coverage. Here are the top 3 things discussed with clients when it comes to cyber insurance:

- Do I really need cyber insurance?

- What is covered with cyber insurance?

- How much does a policy cost?

Through a recent partnership with NJ Cyber Insurance Broker, Datastream, BMT is able to refer services. Please review our short video that addresses the questions above, and reach out for a complimentary quote. We can determine if you are a good candidate for cyber insurance and connect you with Datastream who will provide detailed coverage and pricing information.

Click here to receive a complimentary cyber insurance quote for services